I have a blog where I discuss various legal issues. Sometimes the issues cross over with this more … nerdy-culturally-aimed blog …

Thought you might get a kick out of it …

Celebrity Spotlight: Marvel Comics

Bankruptcy affects people of every age, creed, sex or ethnicity from every part of the country. Even celebrities both loved and disliked have their financial problems and depend on the bankruptcy laws to get out from under crippling debt.

Sometimes even superheroes…

From Den of Geek: my thanks for aloowing me to reprint their wonderful article…

Marvel Comics had grown in stature throughout the ’60s, ’70s, and ’80s thanks to the often stunning art and storytelling in such comics as Fantastic Four and The Amazing Spider-Man, Marvel’s financial success had reached a peak by the early ’90s. But then a series of bursting financial bubbles and questionable business deals saw Marvel’s stock value collapse; shares once worth $35.75 each in 1993 had sunk to $2.375 three years later. An ugly fight between a group of very rich investors followed, and for a while, the company’s future seemed uncertain.

Yet somehow, Marvel fought through all the corporate intrigue which dogged the company in late 1996 and for many long months afterwards, and emerged from the rubble a decade later as a film industry behemoth.

In 1993, while Marvel and the comics industry as a whole seemed to be in rude health, Sandman writer Neil Gaiman stood before about 3,000 retailers and gave a speech which few in attendance wanted to hear.

In it, he argued that the success of the comic book market was a bubble – one brought on by encouraging collectors to buy multiple editions and hoard them up in the hope that they’ll one day be worth a fortune. This, Gaiman said, was akin to tulip mania – a strange period in the 17th century when the value of tulip bulbs suddenly exploded, only for the market to collapse again.

“You can sell lots of comics to the same person, especially if you tell them that you are investing money for high guaranteed returns,” Gaiman said. “But you’re selling bubbles and tulips, and one day the bubble will burst, and the tulips will rot in the warehouse.”

The bubble Gaiman described had begun several years earlier, when comic books, once considered disposable items by parents, were becoming prized items by collectors who’d grown up with their favorite superheroes as kids. By the 1980s, comic book collecting had gained the interest of the mainstream media, which latched onto stories about Golden Age comics selling for thousands of dollars.

Publishers were themselves courting the collector market by introducing variant covers, sometimes with foil embossing or other eye-catching, fancy printing techniques. These were snapped up hungrily by readers, but also by speculators assuming that they’d stumbled on a sure-fire means of making money by storing copies up and selling them for a profit in the future.

While the comics were flying off the shelves, Marvel attracted the interest of a man named Ron Perelman. Often pictured with a broad grin and a huge cigar in his hand, Perelman was a millionaire businessman with a variety of interests: in 1985, he’d made a huge deal for cosmetic firm, Revlon through his holding company, MacAndrews & Forbes. In early 1989, Perelman spent $82.5 million on purchasing the Marvel Entertainment Group, then owned by New World Pictures.

Within two years, Marvel was on the stock market, and Perelman went on a spending spree: he bought shares in a company called ToyBiz, snapped up a couple of trading card companies, Panini stickers, and a distribution outfit, Heroes World. All told, those acquisitions cost Marvel a reported $700m.

Through the early ’90s, Marvel was buoyed by the success of Spider-Man and X-Men, which were selling in huge numbers. Sales of a new comic, X-Force, were similarly huge, thanks in part to a cunning sales gimmick: the first issue came in a poly bag with one of five different trading cards inside it. If collectors wanted to get hold of all five cards, they – you guessed it – had to buy multiple copies of the same comic. With the boom still in full swing, that’s exactly what collectors did – as former Comics International news editor Phil Hall recalls, fans were buying five copies to keep pristine and unopened, and a sixth to tear into and read.

Then, just as Gaiman predicted, the bubble burst. Between 1993 and 1996, revenues from comics and trading cards began to collapse. Suddenly, Marvel, which at one point seemed invincible as it grew in size, now looked vulnerable.

“When the business turned,” observed then-chariman and CEO of Marvel Scott Sassa, “it was like everything that could go wrong did go wrong.”

Some in the industry went further, and argued that Perelman’s tactics had endangered the entire industry:

“[Perelman] reasoned, quite correctly, that if he raised prices and output, that hardcore Marvel fans would devote a larger and larger portion of their disposable income toward buying comics,” Chuck Rozanski, wrote CEO of Mile High Comics. “Once he had enough sales numbers in place to prove this hypothesis, he then took Marvel public, selling 40% of its stock for vastly more than he paid for the entire company. The flaw in his plan, however, was that he promised investors in Marvel even further brand extensions, and more price increases. That this plan was clearly impossible became evident to most comics retailers early in 1993, as more and more fans simply quit collecting due to the high cost, and amid a widespread perception of declining quality in Marvel comics.”

Whether Perelman was directly to blame or not, the consequences for the industry as a whole were painful in the extreme. Hundreds of comic book retailers went bust as sales tumbled by 70 percent. Suddenly, the boom had turned to bust, and even Perelman admitted that he hadn’t anticipated the dark future Gaiman had warned about in his speech.

”We couldn’t get a handle on how much of the market was driven by speculators,” Perelman said; “the people buying 20 copies and reading one and keeping 19 for their nest egg…”

By 1995, Marvel Entertainment was heavily in debt. In the face of mounting losses, Perelman decided to press on into new territory: he set up Marvel Studios, a venture which he hoped would finally get the company’s most famous characters on the big screen after years of legal disputes. To do this, he planned to buy the remaining shares in ToyBiz and merge it with Marvel, creating a single, stronger entity.

Marvel’s shareholders resisted, arguing that the financial damage to Marvel’s share prices would be too great. Perelman’s response was to file for bankruptcy, thus giving him the power to reorganize Marvel without the stockholder’s consent.

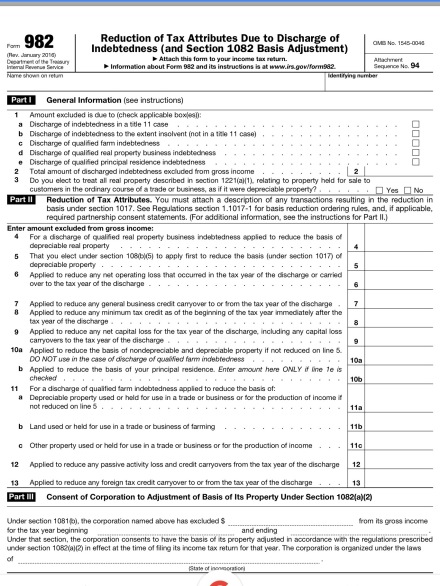

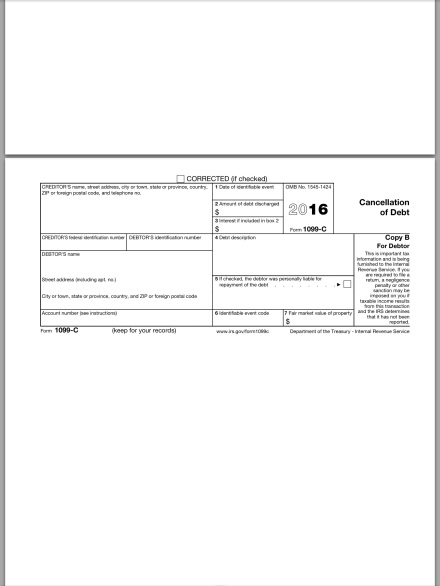

Marvel filed Chapter 11 bankruptcy on December 27, 1996. Coincidentally, its highest debt of $1.7 million was owed to Disney. Over one-third of Marvel employees were laid off.

There followed a bewildering power struggle which raged for almost two years. A stockholder named Carl Icahn tried to oppose Perelman, and the financial press eagerly reported on the very public spat which ensued. Perelman, Icahn argued, “Was like a plumber you loan money to get him started in business; then he comes in, wrecks your house, then tells you he wants the house for nothing.”

The battle, when it finally ended in December 1998, had a strange outcome which few could have predicted: after a lengthy court case, ToyBiz and Marvel Entertainment Group were finally merged, but Perelman and his nemesis Icahn were both ousted in the process. Other executives with ties with Perlmutter were also severed, including CEO Scott Sassa, whose tenure had, all told, lasted just eight months.

They’d been pushed out by two ToyBiz executives who’d been on Marvel’s board since 1993: Isaac Perlmutter and Avi Arad. With Scott Sassa gone, they installed the 55-year-old Joseph Calamari, who’d been at the helm of Marvel in the 80s, as its new CEO.

With the financial intrigue in the boardroom settling down, Marvel began to turn its attention to a target it had been trying to hit since the 1980s: the movie business. The rest, as they say …

***

Please check my legal blog for other famous bankruptcies!

***

***

About the author: Michael Curry is the author of the Brave & Bold: From Silent Knight to Dark Knight, The Day John F Kennedy Met the Beatles and the award-winning Abby’s Road, the Long and Winding Road to Adoption and How Facebook, Aquaman and Theodore Roosevelt Helped. Check his website for more releases! Thanks for reading!